Profit Calculator Changes for Amazon Charging VAT on Fees

As of 1 August Amazon will begin charging VAT on their fees for all sellers in EU countries. Click here to read the announcement.

SellerAmp SAS is equipped, in multiple ways, to help you understand the impact to your business. Now available in the Profit Calculator:

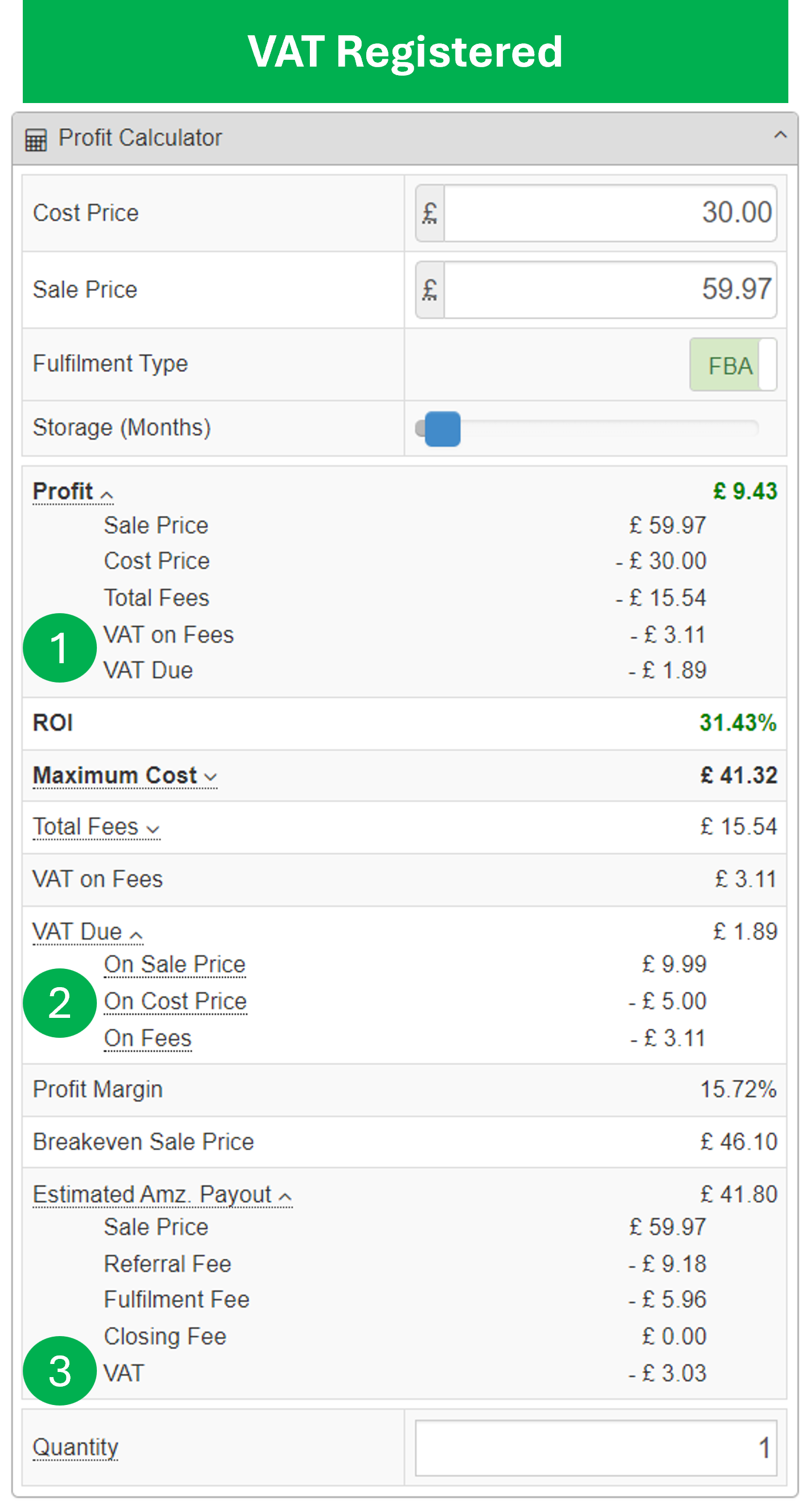

- VAT registered sellers, VAT on Fees is calculated for/displayed in:

- Profit

- VAT Due

- Estimated Amazon Payout

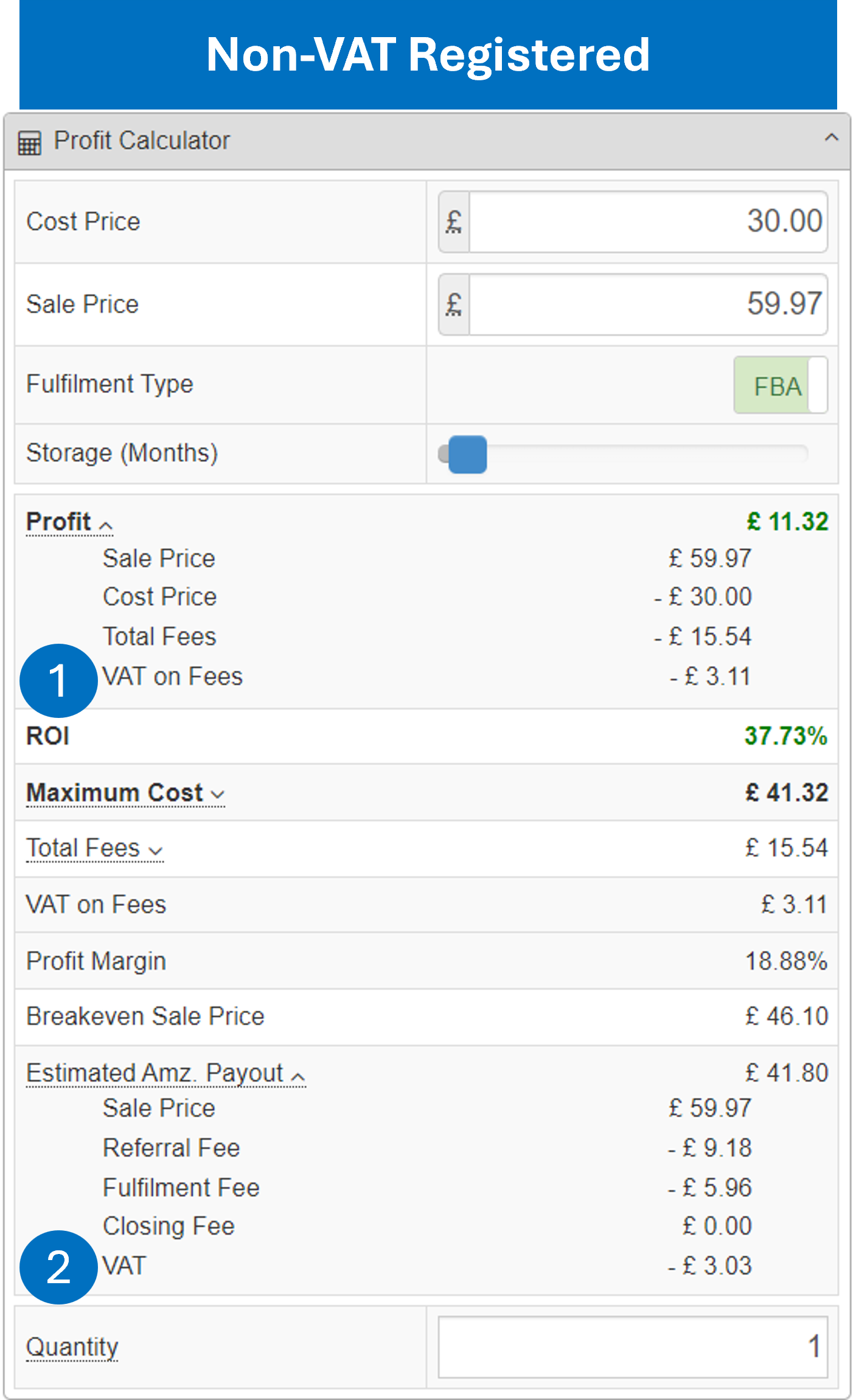

- Non VAT registered sellers, VAT on Fees is calculated for/displayed in:

- Profit

- Estimated Amazon Payout

PRIOR TO 1 AUGUST you can toggle on the “VAT on Fees (Aug 2024)” button, to see the impact of VAT on Fees. Default the toggle to on in Settings, or change per product in the VAT Settings panel.

ON 1 AUGUST the the “VAT on Fees (Aug 2024)” toggle will disappear and VAT on Fees will be applicable in all VAT marketplaces.

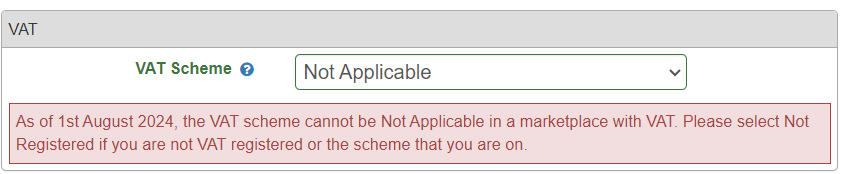

NOTE: If your Marketplace is set to Canada, France, Germany, Italy, Spain or UK, and your VAT status is set to “Not Applicable” your VAT Status will automatically be change to “Not Registered” on 1 August to comply with being charged VAT on Amazon Fees.

If you change marketplaces to US (where VAT on fees is not applicable) VAT on fees will not be factored in.